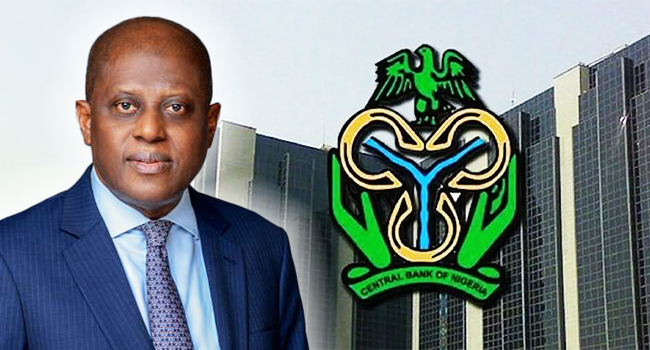

The Central Bank of Nigeria (CBN), has scheduled its first Monetary Policy Committee (MPC) meeting with Yemi Cardoso as Governor for Monday and Tuesday.

Some economic experts have projected that the benchmark interest rate known as the Monetary Policy Rate (MPR) would most likely be tightened to rein in inflation and check further depreciation of the Naira. .

The News Agency of Nigeria (NAN) reports that the last meeting of the MPC was held in July 2023, and was presided over by the then acting CBN governor, Folashodun Shonubi.

At the July 2023 meeting, the committee had raised MPR by 25 basis points to 18.75 per cent from 18.50 per cent.

According to Prof. Ken Ife, an Economist, we are likely to see rates tightening for some time. Either the MPR is kept steady, or it goes up a little more.

“The CBN says it is going for inflation targeting, but there should be more support from the fiscal authorities because a lot of the issues with the economy are not really monetary.

“We have N500 billion going for social intervention annually, the money does not go into the productive sector,” he said.

A past president of the Chattered Institute of Bankers of Nigeria (CIBN), Mr Okechukwu Unegbu, also said that the rates are likely to go up.

Unegbu, however, said that the MPC decisions are not likely to impact the economy in the short-term.

“I expect that the MPC will further tighten the rates, but that might not have any serious impact on the economy.

“President Bola Tinubu has already taken some sensitive policy decisions, even before appointing the CBN governor and the finance minister.

“Floating the Naira was a major error that has caused the nation so much pain, ” he said.

He urged the government to try operating outside the purview of the Organisation of Petroleum Exporting Countries (OPEC), and pricing the country’s major revenue earmer, crude oil, in Naira.

“Nigeria should do something about pricing its oil in Naira. We should leave OPEC, price our oil independently, ” he said.

Unegbu also advised that the government should learn to ignore most economic prescriptions by the World Bank and the International Monetary Fund (IMF) as such prescriptions had never helped the country to grow.

Bismarck Rewane, an Economist and Managing Director of Financial Derivatives, a business management consultancy firm, also suggested that the MPR would be tightened.

According to Rewane, loose monetary conditions are totally different from tight monetary policy.

“We have no choice. They must tighten and tighten well. I suggest nothing less than 200 basis points.

“You fight loose monetary conditions by tightening monetary policy.

“There will be an effect of that because interest rate will increase, people will save more and consume less, and the currency will stabilise over time. There is no quick-fix,” he said.

Leave a Reply