The Federal Government has raised the amount small businesses could access on single digit loans to N5 million to ensure the country’s inclusive economic growth.

The Managing Director and Chief Executive Officer, Bank of Industry (BOI), Dr Olasupo Olusi, made the announcement on Friday during a town hall sensitisation in Lagos on the Federal Government Grant and Loan Scheme.

The event was organised by the Federal Ministry of Finance in collaboration with the Federal Ministry of Industry, Trade and Investments, the Presidency, Bank of Industry and other stakeholders.

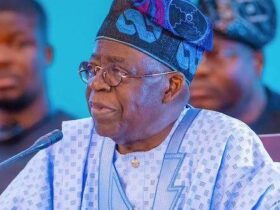

Olusi, represented by Umar Shekarau, Executive Director, MSMEs, BoI, praised President Bola Tinubu for the availability of N200 billion Presidential Intervention Fund for Micro, Small, and Medium Enterprises (MSMEs).

He said N75 billion out of the presidential conditional grant and loan scheme, was targeted for MSMEs, adding that, the initiative was expected to create thousands of direct and indirect jobs nationwide.

The BoI boss said the fund, facilitated through the Bank of Industry (BOI) nationwide, was already sitting in the bank ready to be disbursed to beneficiaries at just nine per cent interest.

He urged business owners to approach the BoI or register online, without going through intermediaries, to benefit from loans and grants.

According to him, over 800,000 Nigerians have benefited and there is room for including youths, women, physically challenged and all Nigerian.

“We maintain our integrity as BoI and disburse the funds,” he said.

The News Agency of Nigeria (NAN) reports that the town hall is holding simultaneously in six states of the federation.

Temitola Adekunle-Johnson, Senior Special Assistant to the President on Job Creation and Micro, Small and Medium Enterprises (MSMEs) said that successful applicants will receive an increased loan of N5 million.

This is against previous N1 million benchmark earmarked to boost their business operations.

He said President Tinubu gave the funds to cushion the effects of challenges experienced by businesses including access to finance, infrastructure, among others.

“The loan is nine per cent three years tenure. A single MSME can collect up to N5 million single digit,” he said.

Minister of Finance and Coordinating Minister of the Economy, Wale Edun, listed interventions of the presidency for small businesses and manufacturing sector and success recorded so far.

Edun, represented by Ahmed Gazalli, said the event marked a pivotal moment in our collective journey toward economic empowerment and sustainable growth.

He said the event was to propagate a shared vision for communal prosperity in a thriving, inclusive economy where every Nigerian had the tools and resources to succeed.

Edun said the government was keenly focused on driving MSME growth and the success of the manufacturing sector to properly reposition Nigeria’s economy.

“It is common knowledge that MSMEs are the backbone of the Nigerian economy and if we do not support our MSME’s to prosper, the Nigerian economy suffers,” he said.

He thanked the MSMEs and beneficiaries in attendance for your hard work, sacrifice, and contributions to the development and stability of Nigeria.

Minister of State for Industry, Trade and Investment, Sen. John Eno, said the government was eager to support programmes and initiatives that promotes welfare of Nigerians.

Eno pledged the government’s commitment to help all the agencies to deliver on their mandates.

He called for collaboration to remove barriers from growth of MSMEs.

“It is such collaboration that can make it work,” he said.

On his part, Mr John Uwajumogu, Special Adviser, Industry, Trade and Investment, explained the gains of supporting industries with finance for inclusive growth

Some of the beneficiaries included, Mr Akor Goddy, a vegetable farmer and vendor from Badagry; Angela Christopher, a nanny; and Mr William Asuquo, a food vendor from Isolo in Lagos. (NAN)

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.