The Presidency has said that the Tax Reform Bill will not increase the number of taxes currently in operation, but rather optimize and simplify existing tax frameworks.

The bill aims to eliminate unintended multiple taxation, make Nigeria’s economy more competitive, and harmonize tax administrative processes across federal, state, and local jurisdictions.

Special Adviser to the President on Information & Strategy, Bayo Onanuga, who made the clarification in a statement on Thursday, said the proposed derivation-based model for Value-Added Tax (VAT) distribution is designed to create a fairer system, where states that produce goods and services will not lose out on VAT revenue.

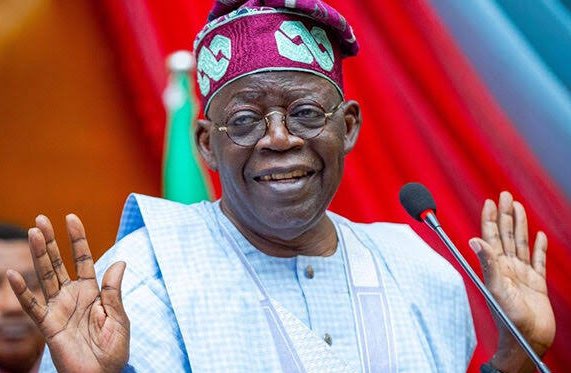

The Tax Reform Bill is part of President Bola Tinubu’s efforts to streamline Nigeria’s tax administration processes, enhance efficiency, and eliminate redundancies. The bill has been sent to the National Assembly for consideration.

The Presidency has assured that the reforms will not lead to job losses, but rather stimulate new avenues for job creation by supporting a dynamic, growth-oriented economy.

The proposed laws will also not absorb or eliminate the duties of any existing department, agency, or ministry, but rather harmonize revenue collection and administration across the federation to ensure efficiency and cooperation.

The Presidency has urged the National Assembly to give due consideration to the bills, which will overhaul Nigeria’s tax systems and create the revenue needed to fund development projects across the country.”

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.