The Nigeria Export Processing Zones Authority (NEPZA) says the country’s Free Trade Zones are business anchorages that have for decades been used to generate revenues for the Federal Government.

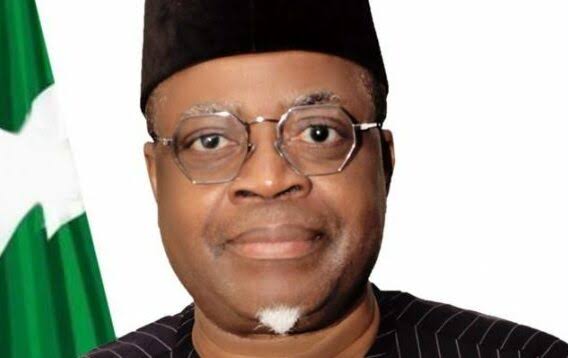

Dr Olufemi Ogunyemi, the Managing Director of NEPZA, said this in a statement by the authority’s Head, Corporate Communications, Martins Odeh, on Monday in Abuja.

According to him, the widely held notion that the scheme is a `free meal ticket’ for the investors and not a means for the government to generate revenue is incorrect.

Ogunyemi said this public statement was essential to clarify the misunderstanding by various individuals and entities, in and out of government, on the nature of the scheme.

He reiterated the authority’s commitment to enhancing public knowledge of the principal reason for the country’s adoption of the scheme by the NEPZA Act 63 of 1992.

“The Free Trade Zones are not hot spots for revenue generation. Instead, they exist to support socioeconomic development.

“These include but not limited to industrialisation, infrastructure development, employment generation, skills acquisition, foreign exchange earnings, and Foreign Direct Investments(FDI) inflows,” Ogunyemi said.

The managing director said the NEPZA Act provided exemption from all federal, state, and local government taxes, rates, levies, and charges for FZE, of which duty and VAT were part.

“However, goods and services exported into Nigeria attract duty, which includes VAT and other charges.

“In addition, NEPZA collects over 20 types of revenues, ranging from 500,000 dollars-Declaration fees, 60,000 dollars for Operation License (OPL) Renewal Fees between three and five years.

“There is also the 100-300 dollar Examination and Documentation fees per transaction, which occurs daily.

“There are other periodic revenues derived from vehicle registration and visas, among others.

“The operations within the free trade zones are not free in the context of the word,” he said.

Ogunyemi said the global business space had contracted significantly, adding that to win a sizable space would require the ingenuity of the government to either expand or maintain the promised incentives.

“These incentives will encourage more multinational corporations and local investors to leverage on the scheme, which has a cumulative investment valued at 30 billion dollars.

“The scheme has caused an influx of FDIs; it has also brought advanced technologies, managerial expertise, and access to global markets.

“For instance, the 52 FTZs with 612 enterprises have and will continue to facilitate the creation of numerous direct and indirect jobs, currently estimated to be within the region of 170,000,” he said.

Ogunyemi said an adjustment in title and introduction of current global business practices would significantly advance the scheme, increasing forward and backward linkages.

“This is with a more significant market offered by the Africa Continental Free Trade Agreement (AfCTA).

“We have commenced negotiations across the board to ensure that the NEPZA Act is amended to give room for adjusting the scheme’s title from `Free Trade Zones to Special Economic Zones respectively.

“This will open up the system for the benefit of all citizens,” he said.

Leave a Reply